Navigating the Diverse Risks in Los Angeles: Protecting Your Home and Business

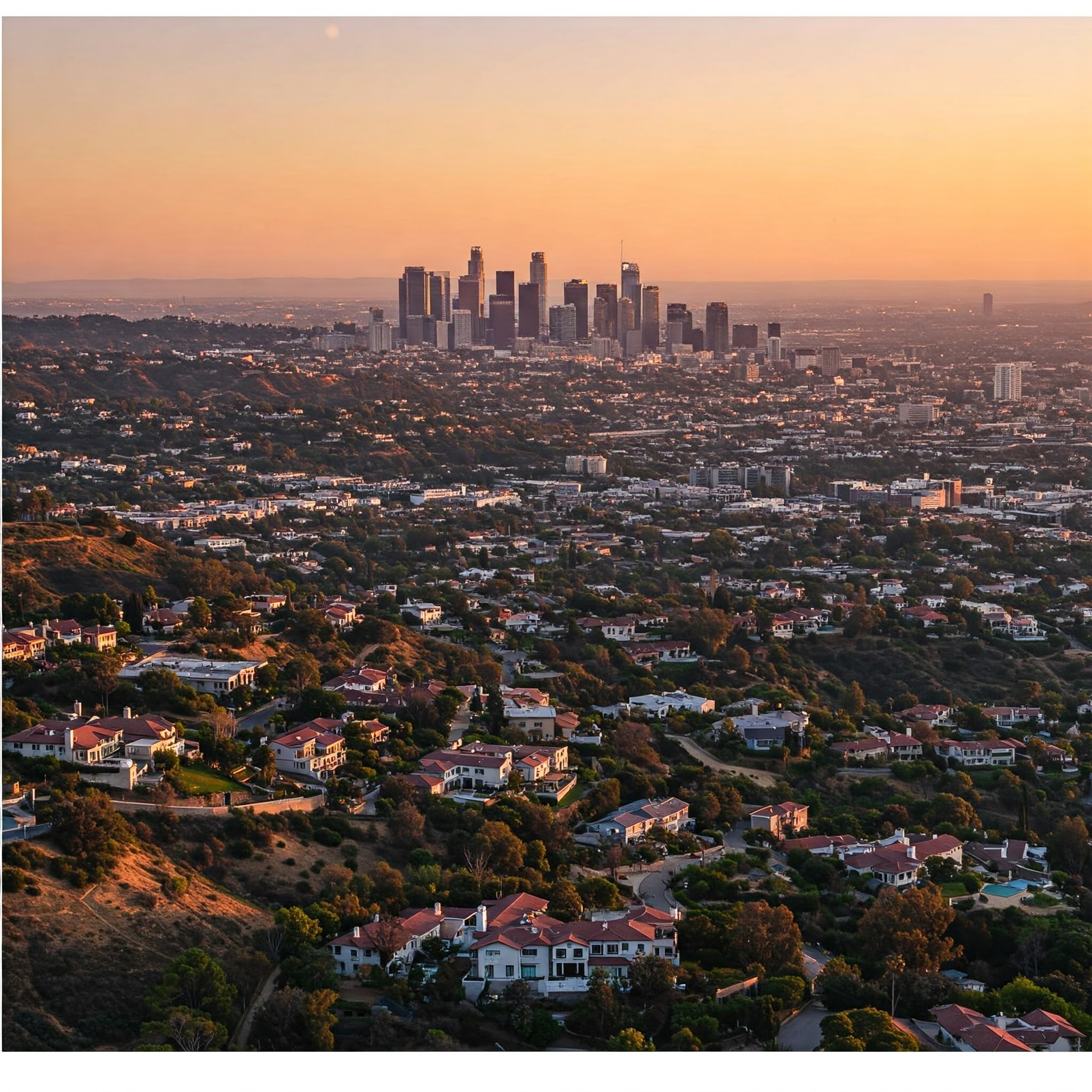

Los Angeles, a vibrant hub of culture, innovation, and natural beauty, also presents a unique tapestry of risks. From the ever-present threat of earthquakes to the seasonal challenges of wildfires and the everyday realities of urban living, Angelenos face a diverse range of potential hazards. Understanding these risks and securing appropriate insurance coverage is crucial for protecting your home, business, and financial well-being.

Earthquake Risk: A Constant Threat

Los Angeles sits in a seismically active region, making earthquakes a significant and constant concern. While predicting the “Big One” remains impossible, the potential for a devastating earthquake is a reality. Standard homeowners and business insurance policies typically exclude earthquake damage, requiring a separate earthquake insurance policy. This specialized coverage can help protect your property and belongings from the shaking, ground movement, and potential aftershocks associated with earthquakes. Understanding your specific risk based on your location within Los Angeles (proximity to fault lines, soil type) is critical in determining the appropriate level of earthquake coverage.

Wildfire Danger: A Seasonal Challenge

The dry climate and brush-covered hillsides of Los Angeles create a significant wildfire risk, particularly during the dry season. Wildfires can spread rapidly, destroying homes and businesses in their path. Homeowners and business owners in wildfire-prone areas must understand their fire risk score and secure adequate insurance coverage. This coverage should include dwelling protection, personal property protection, and potentially even specialized wildfire coverage to address the unique challenges of rebuilding after a wildfire. Defensible space around your property and proactive fire mitigation efforts can also play a vital role in reducing your risk.

Flood Risk: Not Just Coastal Concerns

While coastal flooding is a well-known threat, flooding can occur anywhere in Los Angeles, even inland. Heavy rainfall, overflowing rivers, and inadequate drainage systems can all contribute to flooding. It’s vital to remember that standard homeowners and renters insurance policies typically do not cover flood damage. A separate flood insurance policy, available through the National Flood Insurance Program (NFIP) or private insurers, is essential for protecting your property from this specific peril. Assessing your property’s flood risk and securing appropriate coverage is crucial, regardless of your proximity to the coast.

Urban Risks: Theft, Vandalism, and Liability

Los Angeles’s dense urban environment presents unique challenges, including increased risks of theft, vandalism, and liability claims. Property crimes are a reality in any urban setting, and having adequate insurance coverage for your home or business can help you recover from losses due to theft or vandalism. Personal liability protection is also crucial in an urban environment, as the potential for accidents and subsequent lawsuits is higher. This coverage can protect you from financial losses if you’re held responsible for injuries or damages to others.

Other Unique Risks in Los Angeles:

Beyond the major risks outlined above, Los Angeles residents and businesses face other potential hazards:

- Landslides and Mudflows: Hillsides and areas prone to erosion can be susceptible to landslides and mudflows, particularly after heavy rainfall.

- Extreme Heat: Los Angeles summers can bring extreme heat, posing health risks and potentially impacting infrastructure.

- Traffic Accidents: The heavy traffic in Los Angeles increases the risk of auto accidents, making adequate auto insurance coverage essential.

Mitigating the Diverse Risks in Los Angeles:

While you can’t prevent natural disasters or accidents, you can take steps to mitigate your risks:

- Assess Your Property: Understand the specific risks associated with your location in Los Angeles, including earthquake, wildfire, and flood potential.

- Secure Appropriate Insurance: Work with an insurance professional to identify the right combination of policies to protect your home, business, and personal belongings.

- Implement Safety Measures: Take proactive steps to reduce your risk, such as creating defensible space around your home, installing security systems, and practicing earthquake preparedness.

- Stay Informed: Stay up-to-date on weather forecasts, emergency alerts, and other information that can help you prepare for potential hazards.

Navigating the diverse risks in Los Angeles requires a proactive and informed approach. By understanding the unique challenges of this region and securing appropriate insurance coverage, you can protect yourself from the unexpected and enjoy the many benefits of living and working in this dynamic city. Contact us today for a comprehensive risk assessment and insurance review.