Personal Liability Protection: Safeguarding Your Financial Future in Los Angeles

In today’s litigious society, accidents happen. Whether it’s a slip and fall on your property or an accidental damage you cause elsewhere in Los Angeles, you could be held responsible for injuries or damages to others. Personal Liability Protection, a crucial component of your homeowners or renters insurance policy, acts as a financial shield, protecting you from potentially devastating out-of-pocket expenses if you’re found liable.

What Does Personal Liability Protection Cover?

Personal Liability Protection covers financial losses if you’re legally obligated to pay damages to someone else for:

- Bodily Injury: Medical expenses, lost wages, pain and suffering, and other costs associated with injuries caused to someone else.

- Property Damage: The cost to repair or replace someone else’s property that you’ve damaged.

- Legal Defense Costs: Even if you’re ultimately not found liable, legal defense costs can be substantial. Personal liability coverage typically helps cover these expenses.

Where Does Personal Liability Protection Apply?

This coverage isn’t limited to incidents on your property. It can also protect you from liability for accidents that occur:

- On Your Property: If a guest slips and falls, or if your dog bites someone, you could be held liable.

- Off Your Property: If you accidentally damage someone else’s property while you’re out, or if you’re responsible for an accident while playing sports, you could be protected.

- Anywhere in the World (Typically): Most policies offer worldwide coverage, meaning you’re protected even when you’re traveling.

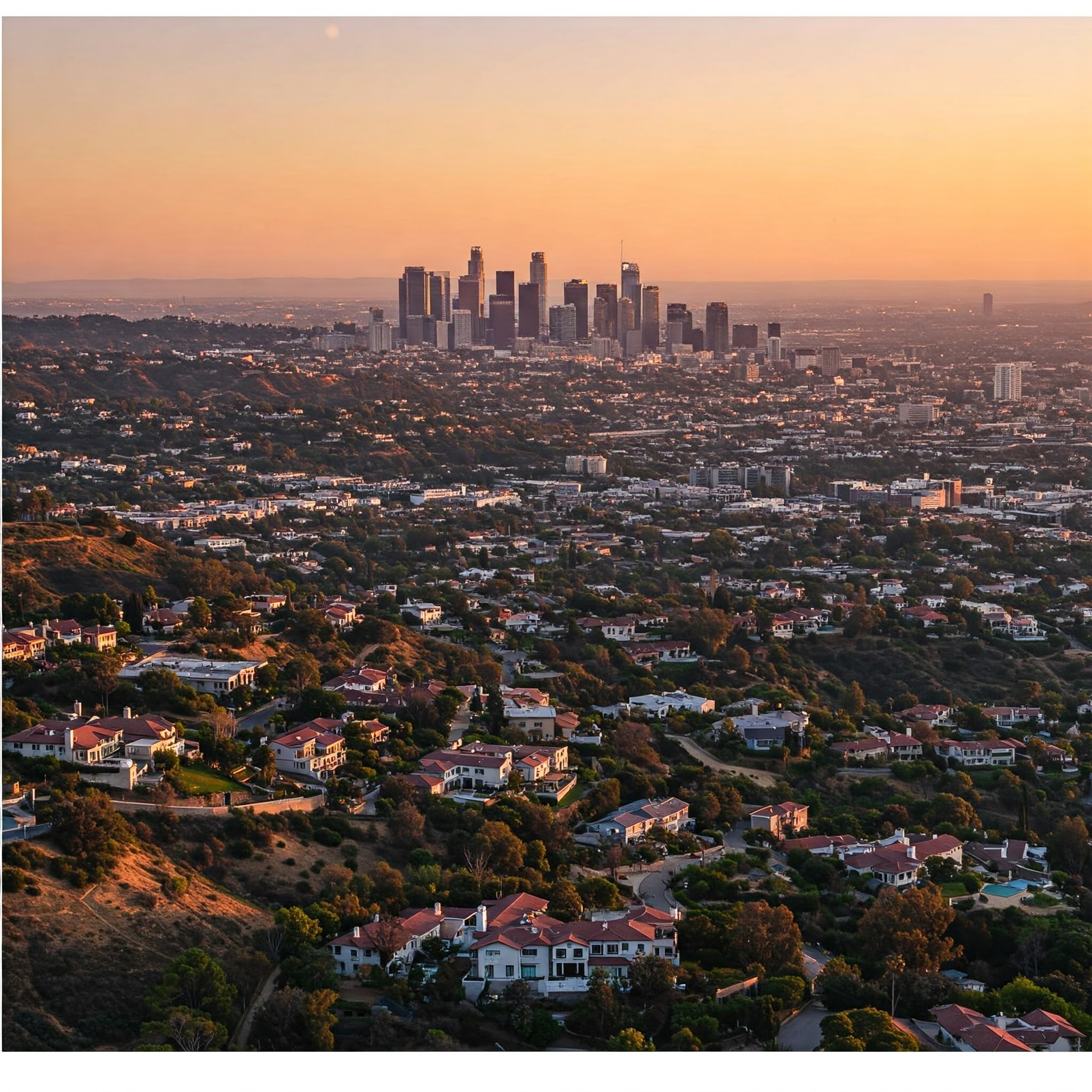

Why is Personal Liability Protection Important in Los Angeles?

Los Angeles, like any large urban area, has a higher likelihood of accidents and potential lawsuits. The high cost of medical care and legal representation in California makes liability protection even more critical.

Benefits of Personal Liability Protection:

- Financial Security: It protects your assets from being seized to pay for judgments or settlements.

- Legal Representation: It provides access to legal counsel to defend you in a lawsuit.

- Peace of Mind: Knowing you have liability coverage allows you to live your life without the constant worry of potential lawsuits.

Understanding Your Personal Liability Protection:

- Coverage Limit: Your policy will have a maximum coverage limit for liability claims. It’s essential to choose a limit that adequately protects your financial interests.

- Exclusions: Certain situations may be excluded from liability coverage, such as intentional acts or business-related activities. Review your policy carefully to understand any exclusions.

- Umbrella Insurance: If you need higher liability coverage than your homeowners or renters policy provides, consider an umbrella insurance policy. This provides an extra layer of protection.

Personal Liability Protection is a vital safeguard in Los Angeles. We can help you understand your coverage options and choose the right level of protection to secure your financial future. Contact us today for a policy review.