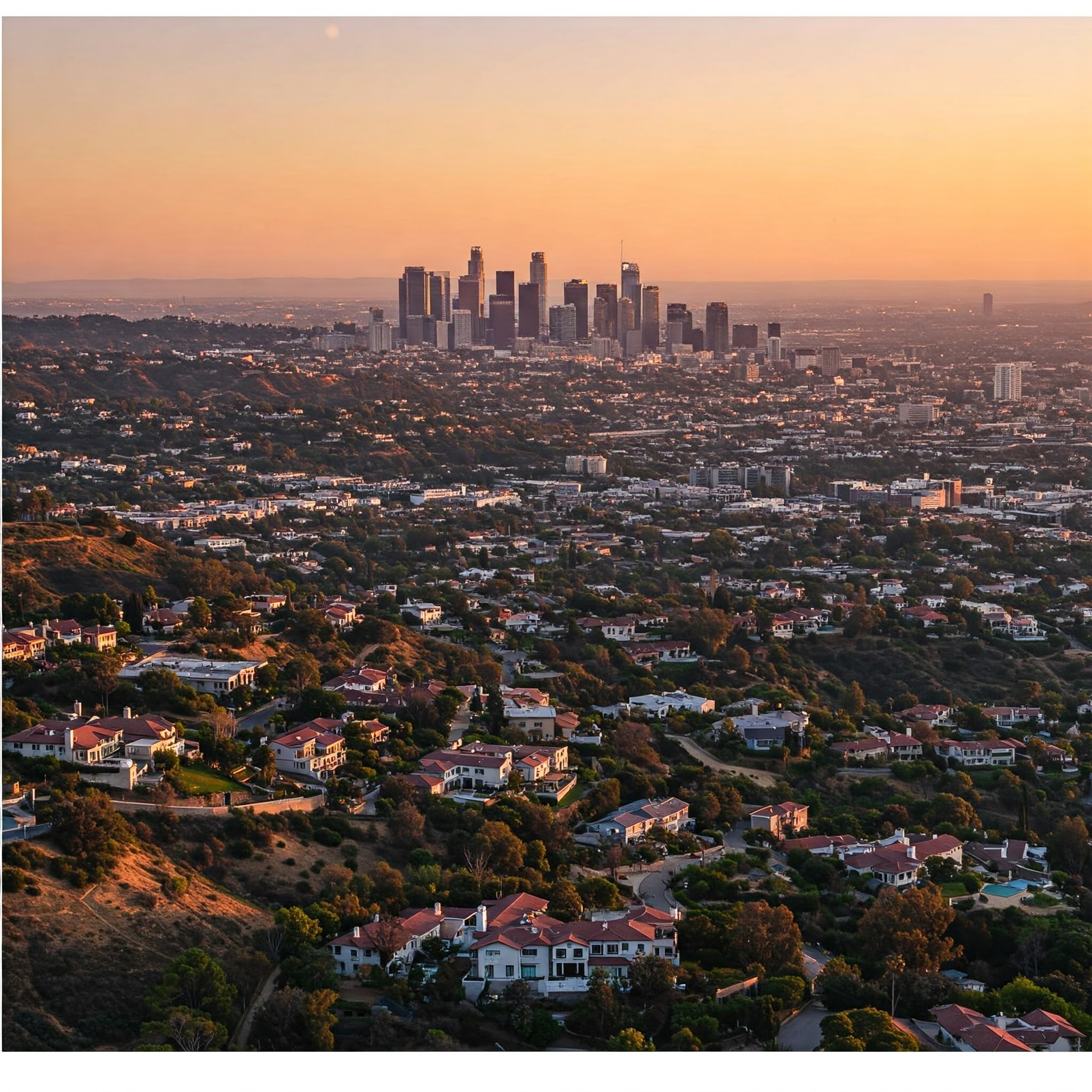

Personal Property Protection: Safeguarding Your Belongings in Los Angeles

Your home in Los Angeles isn’t just bricks and mortar; it’s filled with the things that make it your home – your furniture, electronics, clothing, cherished possessions, and everyday items that contribute to your comfort and lifestyle. Personal property protection, a key part of your homeowners or renters insurance policy, is designed to safeguard these belongings against loss or damage from covered perils.

What Does Personal Property Protection Cover?

Personal property coverage protects your personal belongings within your Los Angeles home. This typically includes:

- Furniture: Sofas, beds, tables, chairs, and other furniture items.

- Electronics: Computers, televisions, stereos, gaming consoles, and other electronic devices.

- Clothing: Your wardrobe, from everyday wear to special occasion outfits.

- Appliances: Smaller appliances like toasters, blenders, and coffee makers (larger appliances are often covered under dwelling coverage).

- Personal Items: Jewelry, artwork, collectibles, sports equipment, and other personal possessions.

Common Covered Perils in Los Angeles:

Just like dwelling protection, personal property coverage typically extends to damage or loss caused by:

- Fire: Whether a small kitchen fire or a larger incident, fire damage to your belongings is usually covered.

- Theft: Personal property coverage helps you replace stolen items.

- Vandalism: Damage to your belongings caused by vandalism is generally covered.

- Water Damage (Certain Situations): While flood damage requires separate coverage, water damage from burst pipes, leaks, or other sudden and accidental incidents is often covered.

- Natural Disasters (Depending on the Policy): Some policies may cover damage to personal property caused by natural disasters like windstorms or hail. However, earthquake damage, like with dwelling coverage, typically requires a separate policy.

Why Personal Property Protection is Important in Los Angeles:

Los Angeles, like any major city, presents certain risks to personal property.

- Urban Living: Theft and vandalism are unfortunate realities in urban areas. Personal property coverage helps protect you from these risks.

- Natural Disasters: While less frequent than in some other areas, Los Angeles can experience natural disasters like wildfires and earthquakes. Having personal property coverage ensures you can replace your belongings if they’re damaged or destroyed in such an event.

- Apartment Living: Renters insurance is crucial for protecting your personal property in an apartment. Your landlord’s insurance typically covers the building itself, but not your belongings.

Understanding Your Personal Property Coverage:

Here are some key aspects of personal property coverage to consider:

- Coverage Limits: Your policy will have a maximum coverage limit for personal property. It’s crucial to ensure this limit is sufficient to replace all your belongings.

- Actual Cash Value vs. Replacement Cost: Some policies offer actual cash value (ACV) coverage, which factors in depreciation. Others offer replacement cost coverage, which pays the current cost to replace the item, regardless of age. Replacement cost coverage is generally recommended.

- Scheduled Personal Property: For valuable items like jewelry, art, or collectibles, you may need to “schedule” them on your policy with specific coverage amounts. This provides more comprehensive protection than standard personal property coverage.

Protecting your personal property is an essential part of a comprehensive insurance plan in Los Angeles. We can help you assess the value of your belongings, understand your coverage options, and choose the right policy to safeguard your possessions. Contact us today for a personalized review of your needs.